Increasing regulatory requirements, the high complexity of corporate processes and the ever-growing mass of data are increasingly demanding the digitalisation of tax compliance management in order to identify tax risks in good time and avoid them in the long term. What is needed is a constantly updated overview of potential tax risks as well as automated processes for handling large volumes of data and monitoring control systems in the tax area.

More transparency and efficiency for a future-proof Tax CMS

However, for many companies, setting up an effective and efficient tax CMS is a major challenge - not least when it comes to indirect taxes. Due to the large number of transactions in which indirect taxes must be taken into account, regular monitoring is very time-consuming. There is often a lack of personnel capacity for these complex and time-consuming audits.

Our range of services

The solution: A data-driven tax compliance management system. Together with our co-operation partner Impero A/S, we offer you the combination of a web-based compliance solution with our mass data analysis tool Tax Intelligent Solution (TIS). This enables you to ensure your tax compliance quickly and in a resource-saving manner thanks to efficient control implementation and documentation - and the system is always up to date.

Tax Intelligence Solution (TIS)

Mass data analysis tool developed by KPMG for analysing and controlling all tax-relevant processes in the company. Using one-off or continuous analyses, discrepancies can be uncovered and made available for further processing in Impero.

Impero

User-friendly compliance management platform from our partner Impero A/S for digitising the tax CMS workflow. The results from TIS can be easily transferred to the system, recommendations for action can be derived and processed there. This enables tax risks to be reduced and potential to be realised.

Automated tax compliance with mass data analysis and workflow management

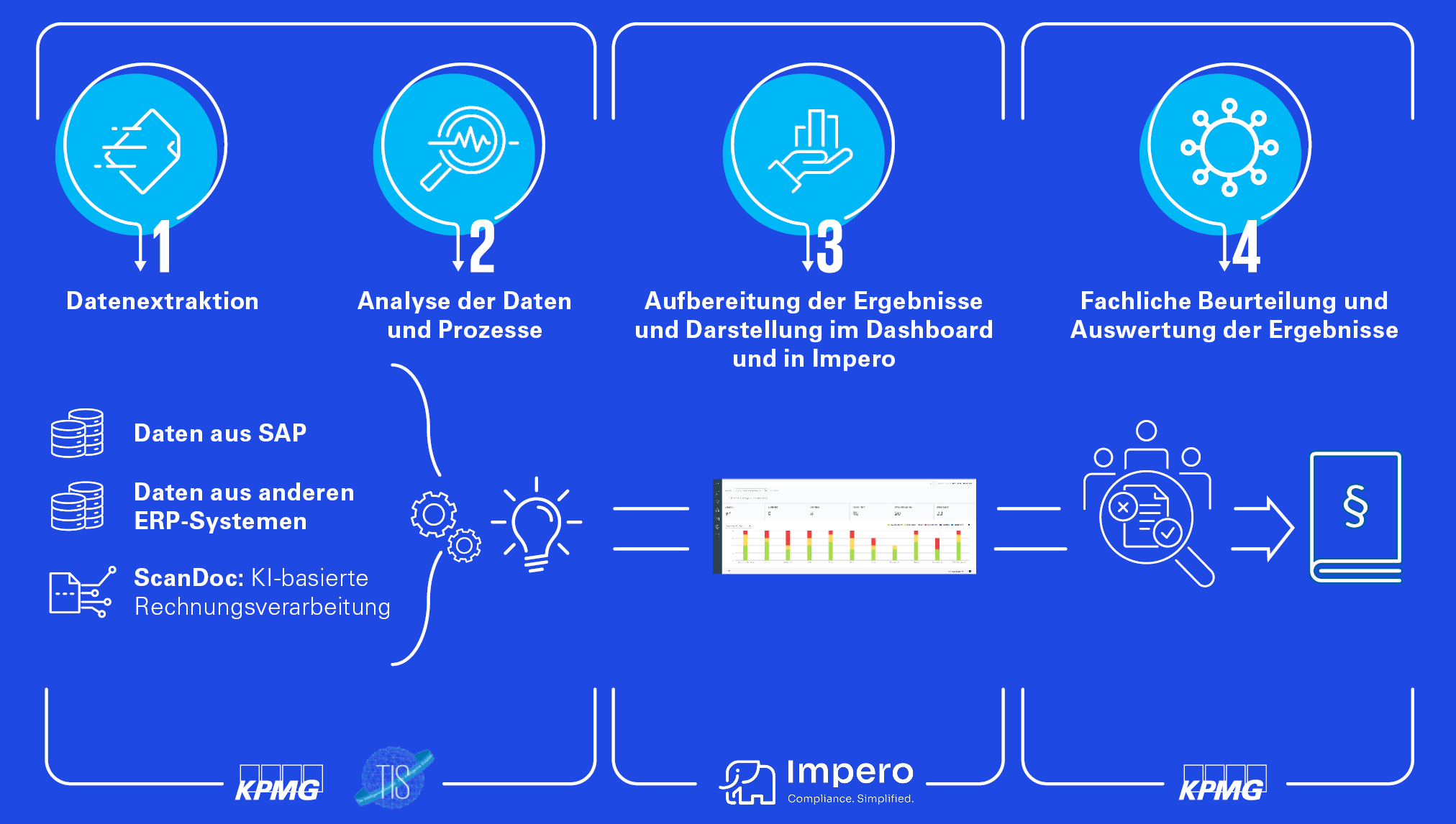

The mass data analysis tool TIS and the compliance management solution from Impero can each be introduced and used independently within the company. Efficiency can be further increased by combining both solutions. The following steps show the interaction between TIS and Impero:

TIS in conjunction with Impero can be established easily, quickly and flexibly in your tax compliance, either directly in your existing processes or seamlessly as a managed service from KPMG. Benefit from flexible solutions instead of a rigid one-size-fits-all approach: select the packages and solutions that suit you and the corresponding content individually.

To summarise, the combination and integration of TIS and Impero enables you to achieve automated, data-driven tax compliance management that will allow you to position yourself even more efficiently and digitally for the future. We would be happy to support you with the implementation.

Our team combines many years of experience and expertise in the fields of tax consulting and data & analytics. This allows us to create new synergies and solutions for the challenges of the present and the future. Get in touch with us.