Article Posted date

29 February 2024

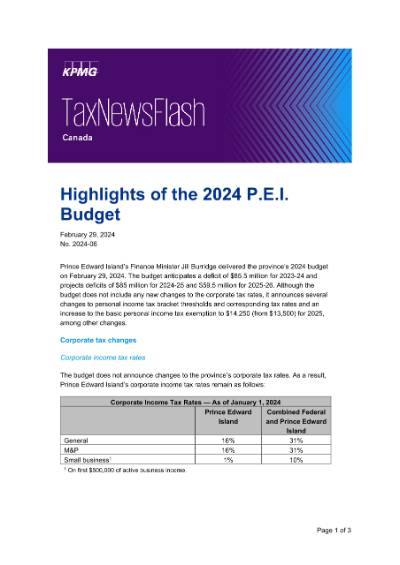

The budget anticipates a deficit of $85.5 million for 2023-24 and projects deficits of $85 million for 2024-25 and $59.5 million for 2025-26. Although the budget does not include any new changes to the corporate tax rates, it announces several changes to personal income tax bracket thresholds and corresponding tax rates and an increase to the basic personal income tax exemption to $14,250 (from $13,500) for 2025, among other changes.

Download this edition of the TaxNewsFlash to learn more.